Empowering Global Support for Imam Hussain’s Holy Shrine Through Bitcoin Donations

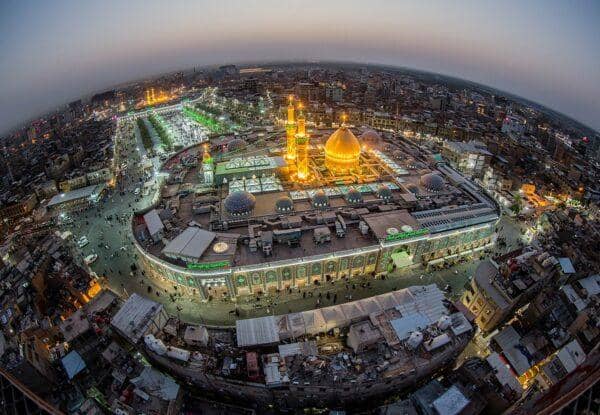

Supporting the preservation and ongoing maintenance of the Imam Hussain Holy Shrine through Bitcoin donations offers a contemporary and efficient means for individuals worldwide to contribute to one of the most revered sites in Islam. Located in the historic city of Karbala, Iraq, these sacred grounds commemorate the life, martyrdom, and enduring legacy of Imam Hussain, the revered grandson of the Prophet Muhammad. Imam Hussain’s sacrifice in the battle of Karbala in 680 AD is a pivotal event in Islamic history, inspiring countless followers with his principles of justice, truth, and steadfastness. Millions of Shia Muslims globally hold the shrine in profound reverence, making it a central destination for pilgrimage, where devotees seek spiritual solace, strengthen their faith, and pay homage to Imam Hussain’s profound impact. The spiritual significance of Karbala, where pilgrims gather from all corners of the earth, underscores the critical need for continuous support to maintain its sanctity and accessibility.

Supporting Imam Hussain Shrine Through Modern Philanthropy

The profound responsibility of maintaining and preserving the Imam Hussain Holy Shrine requires substantial and consistent financial contributions from individuals and organizations globally. These donations are essential not only for keeping the magnificent structures in impeccable condition but also for providing comprehensive services and accommodations for the millions of visitors and pilgrims who arrive throughout the year. Donating Bitcoin to the shrines provides a remarkably convenient and secure method for making these vital contributions, offering accessibility regardless of a donor’s geographical location or the prevailing conditions of the global economy. This modern approach to philanthropy overcomes many traditional barriers, making it easier than ever to support this cherished spiritual landmark.

A Secure, Fast, and Decentralized Way to Support the Imam Hussain Holy Shrine

The use of Bitcoin for charitable giving, particularly for institutions like the Imam Hussain Holy Shrine, presents several distinct advantages over conventional donation methods. For instance, Bitcoin transactions are inherently secure, transparent, and exceptionally fast. This allows individuals to contribute quickly and easily, with transactions often settling much faster than traditional bank transfers, especially across international borders. Furthermore, Bitcoin operates as a decentralized form of digital currency, meaning it is not subject to the control or oversight of any single government or financial institution. This decentralized nature contributes to greater security and enhanced privacy for those who choose to utilize it for their charitable endeavors, reducing bureaucratic layers.

The Advantages of Direct Bitcoin Donations to Imam Hussain Shrine

Another significant benefit of donating Bitcoin to the shrines is the direct channel it provides for individuals to support the cause without requiring multiple intermediaries. This streamlined process substantially reduces the risk of fraud or mismanagement that can sometimes be associated with more complex financial pathways. Moreover, it eliminates many of the common costs tied to traditional giving methods, such as bank fees, wire transfer charges, and often considerable currency conversion fees, ensuring a greater percentage of the donated amount reaches its intended destination. Understanding how to donate Bitcoin to Imam Hussain Shrine involves navigating these modern financial pathways responsibly.

Despite these compelling advantages, it is critically important for individuals considering Bitcoin donations to exercise due diligence. Donors should carefully consider their contributions and thoroughly research the specific organization or cause they intend to support. It is equally important to grasp the potential risks inherent in cryptocurrency, notably the inherent volatility of the market, which can cause significant fluctuations in the value of digital assets. Donors must also be aware of the ongoing possibility of cyber attacks and security breaches that can affect digital wallets and exchanges. Is it safe to donate Bitcoin to Imam Hussain Shrine? The safety largely depends on the donor’s personal security practices and the legitimacy of the recipient organization.

How to Donate Bitcoin to Imam Hussain Shrine

For those interested in how to donate Bitcoin to Imam Hussain Shrine, there are several viable options available, each with its own set of considerations. One straightforward approach is to make a direct donation to the official organizations entrusted with the maintenance and preservation of the shrines. Prominent examples include the Imam Hussain Foundation or the Hussaini Foundation. These reputable organizations typically maintain their own official websites, where they provide comprehensive information on how to make a donation, including clear, step-by-step instructions on how to donate using Bitcoin and other cryptocurrencies. These platforms are often the best way to donate crypto to Karbala as they are directly affiliated.

Secure and Easy Ways to Donate with Cryptocurrency

Another convenient option is to facilitate a donation through a reputable online platform, such as a well-established cryptocurrency exchange or a dedicated crowdfunding website that supports crypto philanthropy. These platforms are designed to allow individuals to make donations using Bitcoin, as well as a variety of other popular cryptocurrencies like Ethereum, and provide a secure and user-friendly means to support the sacred cause.

Supporting Imam Hussain Shrine Through Trusted Islamic Charities

It is also possible to channel Bitcoin donations to the shrines through established charitable organizations, such as the Islamic Charitable Society, which often supports a broad spectrum of causes related to the welfare and development of the global Muslim community. These organizations typically possess a wide reach and administer a diverse range of services and support, encompassing financial assistance, educational initiatives, and healthcare programs. They may act as an intermediary, forwarding the crypto donation to the shrine or using it for related humanitarian projects. For those wondering what do donations to Imam Hussain Shrine support, these organizations often have detailed reports on how funds are utilized, from facility upkeep to pilgrim services.

Ensuring Safe and Legitimate Crypto Donations to Islamic Charities

Regardless of the chosen donation method, a crucial step for all donors is to ensure that their contributions are directed to a reputable and trustworthy organization. This can be achieved through diligent research into the organization and its stated mission, carefully reviewing its transparency reports, and actively checking for any past reports of fraud or financial mismanagement. Seeking the Imam Hussain Shrine official Bitcoin address directly from their verified channels is paramount. Furthermore, considering the legitimacy of such donations from an Islamic perspective, many scholars acknowledge the permissibility of donating through modern financial instruments like cryptocurrencies, provided the funds are legitimate and used for charitable purposes.

Empowering Charity with Crypto: Donating Bitcoin to Imam Hussain

The benefits of donating crypto to Imam Hussain are manifold, extending beyond just financial support to embracing technological advancement in charity. Understanding Bitcoin volatility for shrine donations is key for donors to manage their expectations regarding the fiat value of their contribution at the time of receipt. For those seeking anonymous Bitcoin donation to Imam Hussain, most direct crypto transactions offer a degree of pseudonymity, though full anonymity can be complex to achieve. Supporting Karbala pilgrims with Bitcoin is a direct way to ensure the comfort and safety of millions.

In conclusion, donating Bitcoin to the Imam Hussain Holy Shrine represents a powerful and innovative way for individuals to support one of the most historically and spiritually significant sites in the world for Shia Muslims, actively contributing to the preservation of Imam Hussain’s timeless legacy. With the inherent security, transparency, and speed of Bitcoin transactions, it offers a convenient and accessible means for individuals to make meaningful contributions, irrespective of their physical location or the dynamic state of the global economy. However, paramount importance must be placed on careful consideration of donations and thorough research into the chosen organization or cause to ensure responsible and impactful giving.

As you reflect on the enduring legacy of Imam Hussain and the countless pilgrims who journey to Karbala, you have the opportunity to turn admiration into action. By supporting IslamicDonate, your Bitcoin donation can help preserve this sacred shrine, provide comfort to millions of visitors, and transform digital assets into real-world hope and humanitarian impact. Every contribution, no matter the size, becomes a beacon of compassion and a part of a timeless tradition of giving. Join us in this noble mission and make a difference today: IslamicDonate.com

Support Holy Shrines: Donate with Cryptocurrency